European Front-End Markets: Valuation Strikes Back

- A persistently low-return environment has led European investors to aggressively add duration and target lower credit quality in an effort to improve yield.

- However, we believe more attractive valuations at the front end and a widening of credit spreads have created a much more promising total return environment.

- In our view, a focus on active management and a bias on quality can help investors address two key risks over the medium term: volatility and the prospect of recession.

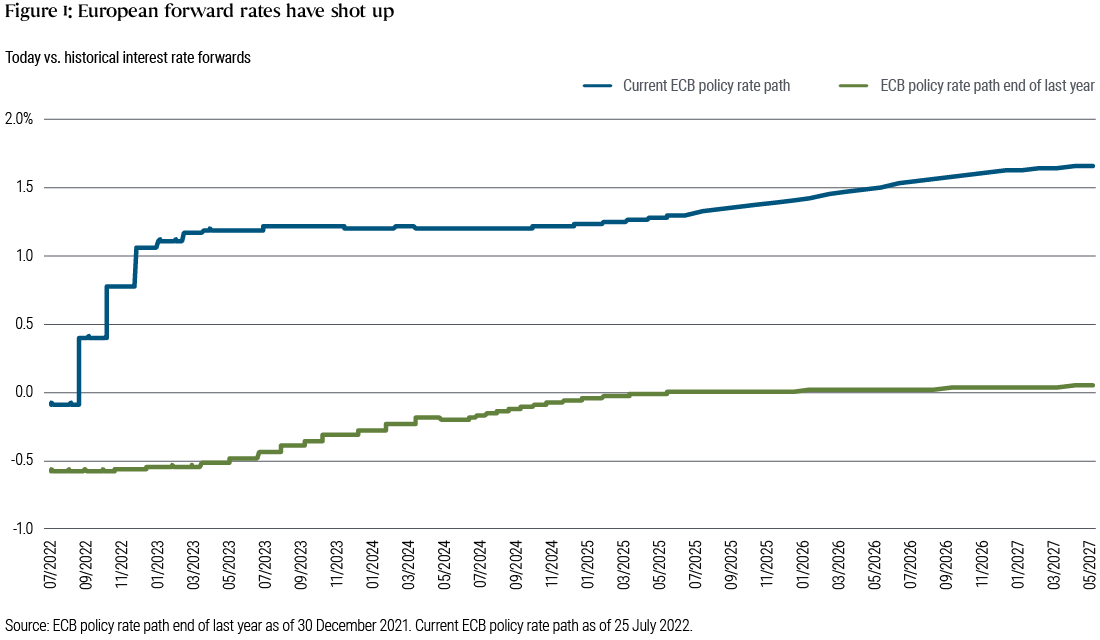

This year will turn out to be an important inflection point for investors in European short-term markets. The European Central Bank (ECB) has not only ended net asset purchases, but is also aiming to bring policy rates back into positive territory. At its July meeting, the ECB increased rates by 50 basis points (bps) – a somewhat surprising turn of events given that this speed of policy normalization was unlikely at the beginning of the year. The July increase was also larger than the rate hike signaled at the ECB’s June meeting, and it finally concludes an eight-year period of negative policy rates. As per current ECB guidance, the policy rate will likely turn positive in September, with further rate hikes to come.

Inflationary pressures as a result of the pandemic and the war in Ukraine have led to a sharp and sudden repricing of the European rates universe, with the ECB currently priced for a 175-bp hiking cycle (which translates into a terminal rate of 1.25% in the deposit facility rate), as shown in Figure 1. We believe that current market pricing finally offers much more reasonable compensation to European front-end investors compared with what has been on offer during most of the last decade. That said, we would not place too much emphasis on various estimates of a neutral policy rate for the euro area; for example, the terminal rate of the current hiking cycle might well end up in restrictive policy territory instead of the broadly neutral 1.25%.

We also believe that the ECB, once it has left negative policy rates behind, will be rather reluctant to re-embark on such a policy measure in the future. Negative policy rates since 2014 were largely an effort to steer clear of sovereign bond purchases for as long as possible, given the elevated political sensitivities around large-scale quantitative easing at the time. Going forward, if a disinflationary environment were to warrant additional accommodation at the zero lower interest rate bound, we believe the ECB would be more likely to resort to broad-based asset purchases, forward guidance, and favorable refinancing operations for the banking sector – without negative rates being part of the monetary policy mix again.

From defense to select offense

While we believe that now may be a good time to deploy capital in European short-term markets, we see two risks that are important for investment decisions over the medium term – risks that argue for a move to select offense, while not entirely abandoning the theme of defense. Volatility ahead (the first risk) speaks to a focus on active management, while the prospect of recession (the second risk) argues for a focus on quality.

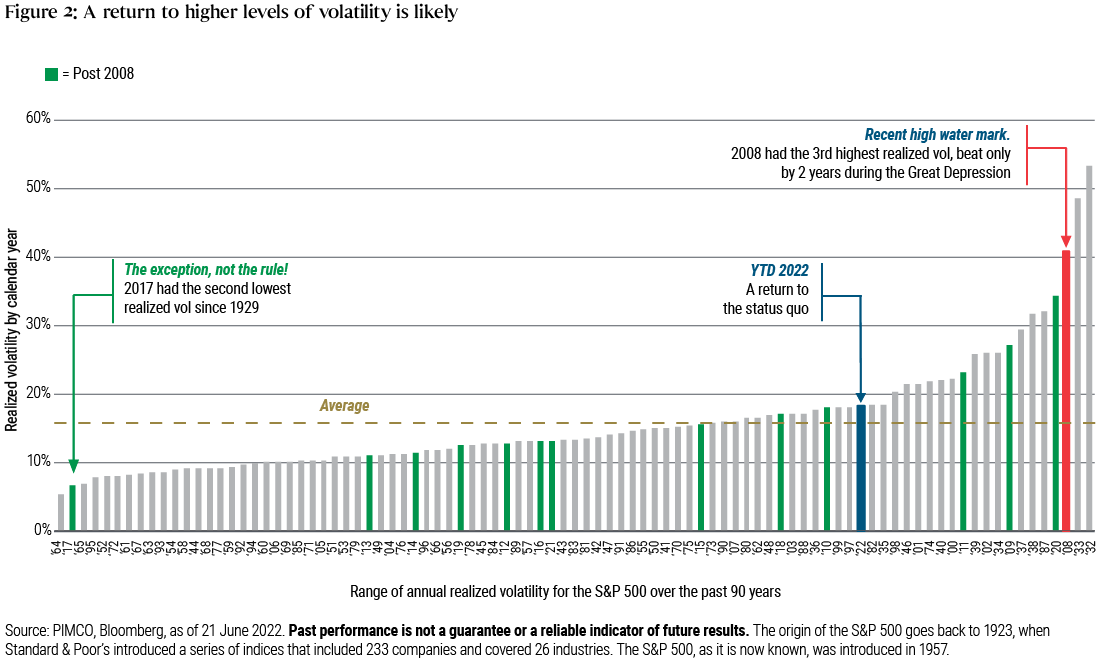

As we have been highlighting in our recent cyclical and secular outlooks, we expect a very different macroeconomic environment compared with recent history, particularly compared with the pre-pandemic backdrop (see Figure 2). We are likely to see shorter macroeconomic and financial market cycles, with larger amplitudes and more divergence between countries, which leads to a considerably more challenging environment for investors to navigate. The world is also fragmenting as we move from a unipolar world (with the U.S. as the sole superpower) to more of a multipolar world. A more fractured world will require a more selective approach when it comes to allocating capital across jurisdictions.

We also live in a world which is too hot in terms of inflation and too cold in terms of growth; a world we have termed, “Anti-Goldilocks.” Recession risks are particularly relevant for Europe, with its outsized dependency on energy imports.

As recession risks rise, credit selection will become increasingly important. We see value returning to some higher-quality segments of the markets on the back of recent credit spread widening. But allocations to some of the most credit-sensitive sectors might be in for a rude awakening, given late-cycle dynamics and diminished central bank support (due to elevated inflationary pressures). In addition, we expect fiscal policies to be much more targeted from here given inflationary pressures and elevated debt levels, in many cases the consequence of broad-based support during the pandemic period.

Short duration strategies can help investors address multiple challenges, from seeking enhanced yield versus traditional cash investments for a modest increase in risk, to reduced market risk and sensitivity to rising rates. And while the very nature of these strategies encompasses certain defensive characteristics, we believe there is little room for a hands-off management approach in general, and under the current circumstances in particular.

The macroeconomic environment speaks to volatile times ahead, and a need for active management of cash and short-term allocations, in our view, with a quality bias – both from a top-down asset allocation and bottom-up credit selection perspective. PIMCO relies on our deep bench of global in-house credit analysts to identify high-conviction credit opportunities while seeking to avoid areas with undue risk of capital impairment.

Risk compensation looks much more reasonable

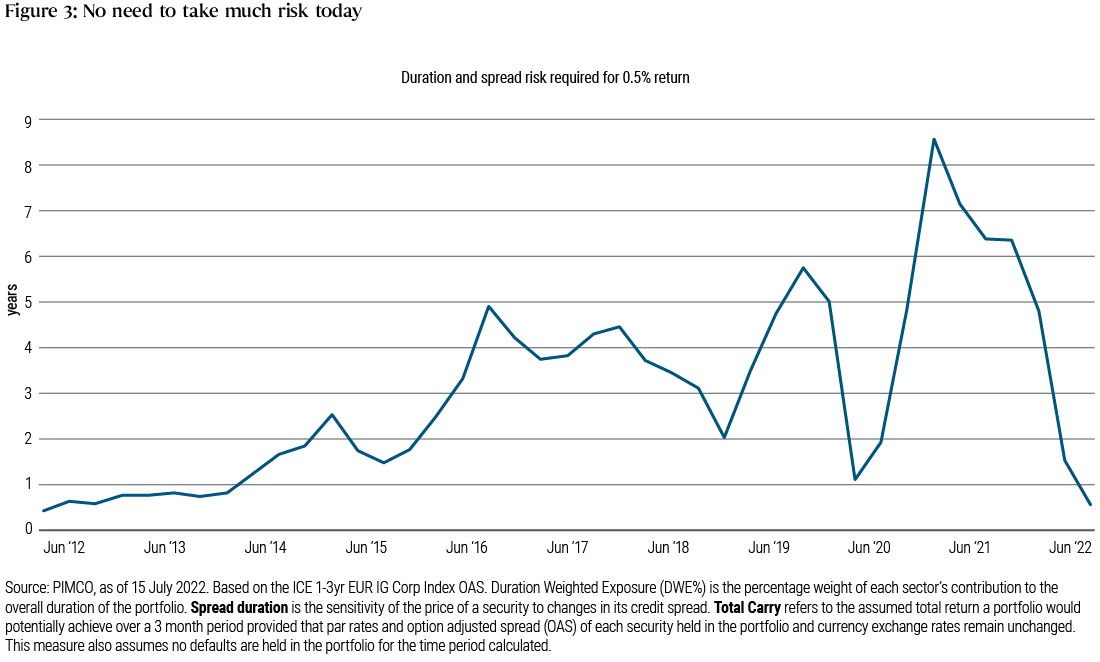

Keeping in mind that focus on active management with a quality bias, we believe investors may now be able to harvest much more reasonable compensation for the risk they are taking in the front end of European yield curves. A lack of compensation has historically led European investors to aggressively climb up the duration and down the credit quality ladders in an attempt to avoid negative returns. But in our view, the repricing of ECB policy rates and widening of credit spreads is now creating a much more promising total return environment – importantly, without the need for excess exposure to duration and credit risk.

Only a year ago, with no end to ECB net asset purchases in sight (and at a time when rate hikes seemed a purely remote prospect), investors had to take around 6.4 years of duration and spread risk to target a 0.5% total carry on their investments (see Figure 3). Today that number has changed considerably, and sits currently closer to 0.6 years of duration and spread risk.

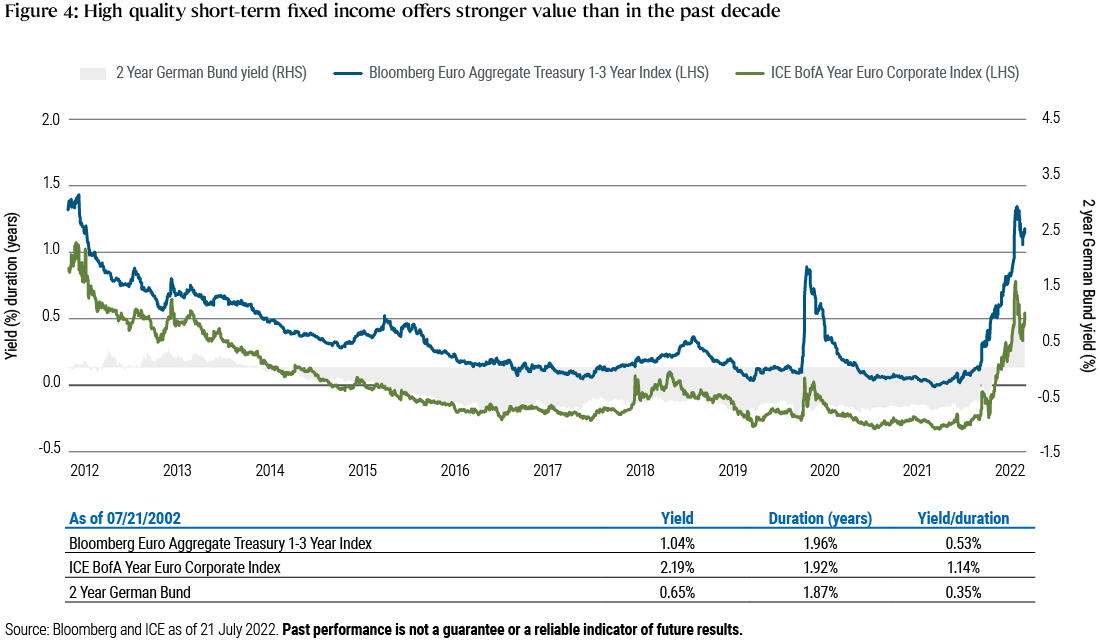

A similar picture can be derived from looking at various low duration indices, with the Bloomberg Euro Aggregate 1-3 Year Index (without corporates and securitized assets) moving from −0.5% up to 1% yield to maturity over the last year (see Figure 4).

A short-term portfolio typically doesn’t run the exact same amount of duration and spread risk. A combination of front end indices is currently able to achieve a 1.6% yield to maturity with a modest one year of duration risk and 1.45 years of high quality spread risk. In our view, this potential risk/return proposition screens attractive not only compared with history, but also compared with traditional cash investments, which tend to yield considerably less and are typically slower to adjust in a rising yield environment. Banks’ reaction to the policy rate cycle in terms of adjustment of deposit remuneration tends to be asymmetric, as the pass-through tends to be rapid and full during monetary policy easing cycles but slow and partial during hiking cycles. This often holds true especially for retail and corporate deposits.

Much-improved total return potential

The European front end is finally screening attractive from a valuation perspective, in our view, as the ECB leaves negative policy rates behind and credit spreads have repriced on the weaker growth outlook. We believe a focus on active management and the higher-quality segments of the credit spectrum will be key for targeting the much-improved total return potential during the volatile and uncertain period ahead.

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. Management risk is the risk that the investment techniques and risk analyses applied by an investment manager will not produce the desired results, and that certain policies or developments may affect the investment techniques available to the manager in connection with managing the strategy.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. It is not possible to invest directly in an unmanaged index. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2022, PIMCO.